Auto insurance providers will usually utilize varying methods when underwriting their policies, so when shopping for car insurance, it’s no surprise to see two or more companies charging wildly different rates for the same person. It is because of this that the best way to secure a great deal on auto insurance coverage is by comparing quotes from multiple insurers before you agree to purchase a policy.

The comparison process is especially important for those who may lack a clean driving record, as the insurance rates can often be significantly higher than average. And even if your driving record is spotless, it helps to compare rates every now and then to see if you can save yourself some money on premiums. Naturally, this is where an auto insurance comparison site like Insurancey can come in handy.

The company is able to instantly provide you with quotes from different auto insurance companies to help you compare different premiums and get the coverage you need.

What Do You Need to Know About Insurancey?

If you are thinking about finding a new insurance provider or you simply want to ensure that you are still getting the most competitive rate, Insurancey is what you should rely on.

It is an independent insurance comparison platform that works with dozens of insurers to help car owners quickly and easily compare auto insurance quotes online. Each search provides an overview of each insurer, the coverage for the quoted price, and more.

This helps users make an educated decision on where to get their car insurance, thereby allowing them to secure competitive deals for themselves. And since the process is conducted entirely online, quotes are provided within minutes based on your criteria and personal details.

This helps you save time by comparing multiple quotes at once, secure the most affordable premiums, and also learn what coverage is best suited to your needs. You also don’t need to submit any excess paperwork to get an auto insurance quote, either.

And unlike most other comparison sites, users can rest assured that any information that is submitted will not result in having to deal with a bunch of spam afterwards.

Insurancey even offers educational resources on its site, such as providing car owners with useful tips, advice, and information about car accessories, for example.

What Makes Insurancey the Best Site for Comparing Car Insurance Quotes?

When comparing insurance quotes, there are a few important factors that the platform you choose must be able to deliver. Luckily, Insurancey has some of the best qualities wrapped in one neat package. These include;

1. Instant Quote Comparisons

With so many insurance providers out there to choose from, assessing quotes one at a time from site to site can be tedious and frustrating. However, Insurancey simplifies that process by making it easy for you to simultaneously assess multiple auto insurance quotes on the same page.

With a single request, finding and securing yourself an affordable and comprehensive policy from some of the top car insurance providers in the country has never been easier.

2. Wide Network of Insurance Providers

Some comparison sites tend to be sponsored by certain companies to present their lowest prices while displaying other companies’ most expensive policies. However, with Insurancey that isn’t a problem, as it is an independent platform, with no affiliations to any single auto insurance provider.

They are partnered with dozens of insurers to provide you with accurate information and a wide pool of options to browse through and secure the best possible deal.

3. Saves Time

It can often be rather tedious to fill out pages upon pages of paperwork, let alone browse multiple insurers’ sites just to get accurate estimates on insurance coverage. With Insurancey, you can access this information using a relatively minimal amount of personal information.

All you need to do is provide a few basic details, and you will be able to instantly compare multiple quotes from different insurers, thereby saving yourself a heap of time in the process.

4. Affordable Insurance Rates

Insurance rates are in constant flux and since every company has its own way of determining these costs, there’s always a chance that you can find an insurer that will offer you an even lower insurance premium with the widest coverage possible. With Insurancey’s help, you will be able to instantly conduct a thorough market analysis that will allow you to save hundreds of dollars each year on car insurance.

5. No Lead Generation

Unlike other comparison sites, Insurancey does not collect contact information from its users to sell to third parties that use it to spam users with promotional calls, texts, and emails. The company maintains strict privacy and confidentiality policies to ensure that its users will not be spammed for simply trying to explore their car insurance options.

6. Online Insurance Quotes

The problem with comparing insurance is that the process can often be quite lengthy, as it involves reaching out to several insurers and waiting for them to promptly respond to your request for a quote. Meanwhile, some comparison sites can even take hours to provide you with the information you need.

However, the good thing about Insurancey is that you can carry out an online assessment in real-time. This enables you to quickly eliminate the insurance providers that don’t meet your needs.

What Factors Influence My Car Insurance Rates?

Before you get an insurance quote from any provider, they will usually need to do some digging on you. In this respect, here are some of the main factors that’ll typically influence how much you end up paying for car insurance.

#1. Value of the car

The value of your car will usually be a big factor in how much you have to pay to insure it. The more expensive it is, the more likely it is that your premiums will be higher because it’ll end up costing more to repair or replace. However, some insurance companies may end up offering discounts if the vehicle has advanced safety equipment or high safety ratings.

#2. Age and driving experience

Most insurance providers will charge higher insurance premiums to younger drivers because they have less driving experience. Naturally, this means that there is a higher risk of them ending up in accidents compared to drivers who’ve been driving for years. In most cases, anyone under 25 can usually expect a higher-than-average insurance quote.

#3. Driving history

Having a poor driving record can potentially affect the type of car insurance rate you get, as it indicates how much of a risk you are on the road. Any car owner with a history of accidents, collisions, or traffic violations tends to end up paying more in premiums. However, the more spotless your driving record is, the more affordable your auto insurance rates will be.

#4. Location

Where you live also plays a major part in determining your insurance rate. For instance, car owners that live in urban areas are considered to be more susceptible to theft, accidents, vandalism, etc. As such, insurers still often charge more than those who live in suburban areas.

Furthermore, the state you reside in can also influence how much you are charged, as each state has its own regulations that can affect how premiums are calculated.

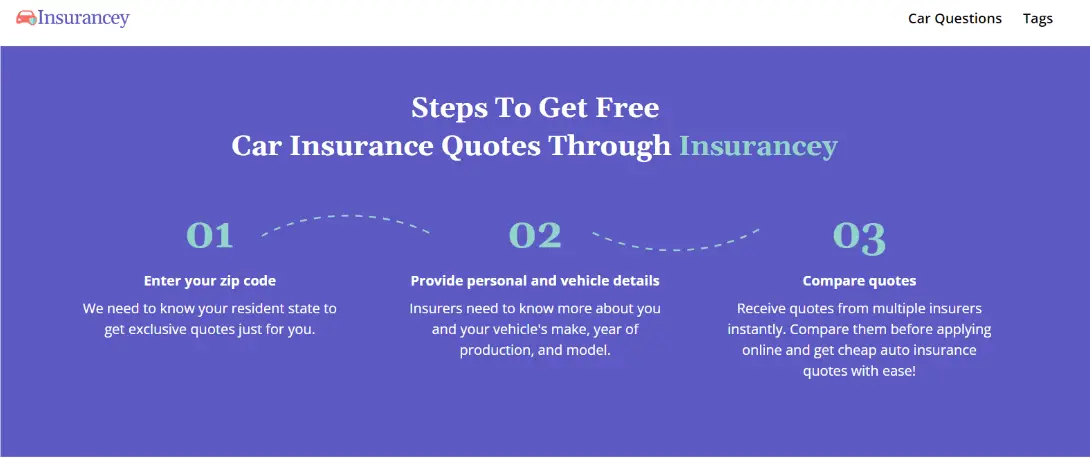

How Do I Compare Car Insurance Quotes Using Insurancey?

Getting auto insurance quotes via Insurancey is a simple, three-step process that only takes a few minutes to complete and secures the best deal possible.

Step 1: Submit your details

Navigate to insurancey.io and start by inputting your ZIP code. After this, you will need to share your personal details, such as your name, address, email, phone number, etc. You will also need to fill in information about your driving and insurance histories, as well as share detailed car specs such as its make, model, year, etc.

Step 2: Compare insurance quotes

Once you have filled out all the necessary information and submitted the form, you will be matched with a list of insurance providers that offer coverage in your area. When evaluating quotes, it is important to keep in mind that while affordability is important, the cheapest option is not always necessarily the best. This means taking everything from price to type of coverage to even the auto insurance provider’s claim settlement ratio into account.

Step 3: Secure your preferred policy

With these factors in mind, you will be able to pinpoint the ideal policy. At this point, it is as simple as proceeding to the site of the insurer to complete the application process. Within a short amount of time, you will be on your way to officially sealing the deal on your preferred auto insurance coverage.

Who Can Use Insurancey To Get Cheap Auto Insurance Quotes?

There are certain people who typically struggle to secure themselves an affordable auto insurance deal for one reason or another. It is in such times that a platform like Insurancey comes in handy, with some of the most plagued drivers being;

1. Inexperienced drivers

Insurance companies typically consider people under the age of 25 as inexperienced drivers who are highly likely to make mistakes and get involved in collisions or accidents. The more high-risk you are, the more likely it is that the rates you are offered by insurers will be higher than average.

If you fall under this category, Insurancey can help you quickly compare auto insurance quotes from various providers and secure the best rates possible.

2. Dangerous drivers

Dangerous drivers or high-risk drivers are essentially those with poor driving records who have been previously convicted of DUI or DWI. These types of drivers also tend to have filed multiple insurance claims in the past.

Most providers would rather avoid insuring such drivers, but most states require them to be insured so that potential accident victims can be compensated. As a result, they are often charged very high premiums, which is why comparing quotes with Insurancey can be helpful in finding reasonably-priced coverage, even with unpleasant driving records.

3. High-end luxury car owners

Owning a luxury vehicle can be glamorous for the most part, but it also has its downsides. One of which is the fact that securing car insurance can be quite an expensive endeavor.

After all, repairing or replacing such vehicles can be expensive, not to mention that there is a higher risk of theft. In such cases, Insurancey can be a useful resource to help you compare potential quotes from numerous experienced high-end vehicle insurers and get yourself a reasonable deal.

How Does Automobile Type Affect My Car Insurance Rates?

Car insurance rates are usually determined by a wide variety of factors, with one of the main considerations being the type of vehicle that you own. After all, some cars are typically more expensive to repair and have a higher claim risk, compared to others.

As such, most insurers will typically charge varying premiums for certain makes and models. For instance, sedans typically have low claim records, and as a popular choice among experienced and responsible drivers, their insurance premiums are often moderate.

Another similar example is SUVs, which often come with high safety ratings and, as such, their premiums tend to be very cheap. On the flip side, luxury sports cars tend to be very expensive, and given that their drivers are typically risky, they often end up demanding higher insurance premiums.

Similarly, hybrids and electric vehicles (EVs) also demand high insurance rates because these vehicles often come with highly sophisticated systems and technologically-advanced battery cells. If any of these parts end up damaged, they can sometimes end up costing thousands of dollars just to repair, which is why they are often more expensive to insure than the typical gas-powered car.

Comments