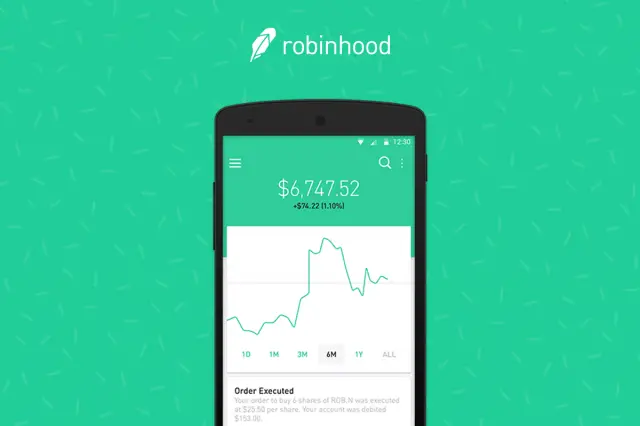

Robinhood – the stock trading platform that promises to revolutionize an industry (and we don’t doubt it considering they’re backed by Google) – is now officially available for download. The app has been available on iOS for almost a full year, albeit through a quite stringent invite-only process. As for a desktop version? It doesn’t exist (and possibly never will).

Whereas most popular stock trading platforms charge flat fees for every single transaction, Robinhood offers users to make simple trades for absolutely zero dollars. It sounds too good to be true, but the idea is to sell premium memberships for margin trading, and also make money on the backend by selling aggregate data collected from their hopefully growing masses of users.

Not convinced your money is safe? Robinhood is a member of the SIPC so you’re protected for up to $500,000, but let’s be honest, do you really think Google would let one of it’s pseudo-subsidiaries default on a customer? I wouldn’t bank on it.

Robinhood is an especially great tool for:

- Beginning investors who to “Play” (aka learn) but with real money

- Day traders

- Swing traders

If you’re interested in investing, I’d point you to InvestingForums.com, where I initially started my own $10,000 Robinhood Stock Trading Challenge when it launched for iPhones and iPads. The community there is small, but it’s a website I hope will grow with my own knowledge, experience, and bank account. Come join the ride.

Let’s do some quick math on why Robinhood would be good for the beginning investor or high volume trader. The typical transaction fee is about $15 (varies on company and account type). That means you’ll have to pay $15 when you buy the stock and $15 when you sell the stock for a total of $30. Now let’s suppose you are buying 1 share of a $100 stock. With most companies, that stock would need to increase by 30% and then you would only break even. With Robinhood, that’d be $30 bucks in your pocket.

The reality is that you shouldn’t be buying one share of a $100 stock and planning to make money, that’d be a silly investment. The more shares you buy (assuming the same share price) the more diluted that per share transaction fee becomes, but if you’re making a lot of trades it can add up quickly. I wouldn’t start investing by trying to make a lot of quick in-and-out money making trades, but nonetheless why spend money when you don’t have to?

Are you an investor? Have you heard of Robinhood? Would you be interested in playing a Phandroid-sponsored stock trading game/contest on InvestingForums.com? Let us know in the comments!

[Via Investing Forums]

Comments