At $370 (after $50 mail-in rebate) with a 2-year agreement, the Samsung Galaxy Note 2 is far from wallet-friendly. But you know what stings more than that? Trying to pony up the $650-$700 and buying one full price (no contract). Now that is sure to break the bank.

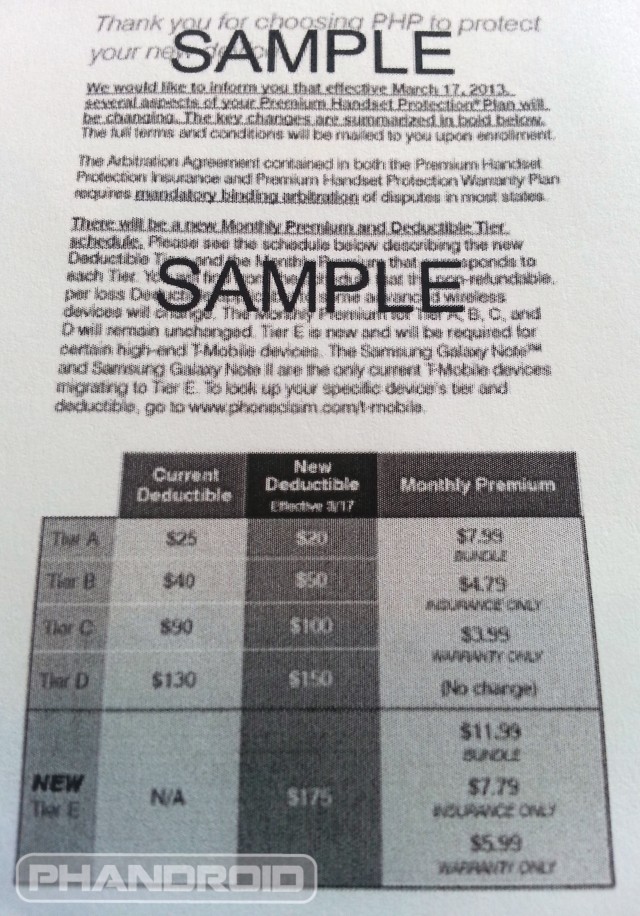

Given that the G-Note 2 is one of T-Mobile’s most expensive offerings ever, it seems they have to create a whole new tier for those wanting to make sure their investment is protected through Asurion. Starting March 17th, the Samsung Galaxy Note 2 will cost a whopping $175 to replace, while paying anywhere from $6, to $12 a month to keep it insured. That’s not all. It looks like the standard deductible to insure any smartphone on T-Mobile will also go up an extra $20, jumping from $130 to $150 with the monthly charges remaining the same.

Some quick math tells us that you could be paying upwards of $288 over the life of your contract (and that’s if nothing were to happen to your device). If your phone drops and breaks requiring a replacement — that’s around $463 total. While I could see it making sense to insure a brand new phone like the Note 2 upfront, I can’t see how it would be worthwhile after a year (phones depreciate quickly). A year from now you’ll most likely be able to find a Note 2 on Craigslist for around $200.

Of course, there are always alternative insurance providers like SquareTrade who will insure a device for around $7 with a $100 deductible. Question: do any of you guys insure your Android devices? If so, for how long? Or perhaps you prefer to let fate decide when it comes to your smartphone’s future?

BEST BUY.

Yup…they don’t fuss over anything. I’ve replaced more than 4 phones now, and paid nothing above the monthly they charge us.

are you saying for the duration of your contract, best buy will replace your phone with no additional monthly fees?

yes but it it will take a month, i took out my Droid Incredible’s screen…about a week after its EOL, exactly a month later, i got a replacement, it wasn’t what i wanted, or the phone they took back from me, but i got a replacement…

When I had best buy insurance way back it only took couple days and my friend just filed claim with bb and it only took them 5 days.

You guys were lucky. Took over a month to get my Atrix replaced. They sent it in to get fixed, then lost it. Had to wait a month before they could (would) do anything.

+1 for Best Buy. I have teenagers. Holy crap can they destroy phones. I have not once had to pay anything out of pocket other than the $9.99 monthly fee. No deductible, no questions asked. Nothing but good things to say about the Black Tie for mobile phones.

Can you get Best Buy insurance for phones not purchased from Best Buy? Also, do they cover in case of theft or loss?

Nope not at all…. No loss/theft protection either.

you must buy the phone from best buy as it is a way to draw in customers. And I do not believe they cover theft.

You mean Geeksquad. They also DON’T cover STOLEN/LOST phones and cost more per month as well as.

Its true they don’t cover loss or stolen but neither does square trade. I don’t know about tmobile but I think sprint or asurion in this case will cover up to loss or stolen claims a year.

Asurion t-mobile does cover theft/loss

Do they cover rooted phones?

ripoff, better to go with squaretrade!

Have you filed any claims yet with SquareTrade? If you have, please tell me about your experience….

the claim process is really straight fwd with no hidden fees. i personally haven’t used their smartphone coverage but wouldn’t hesitate if i were to get one. i’ve only used their coverage for laptops and tvs. as far as claims, once they have all of your info as in proof of purchase and exact detail of the electronic, you would send it in for repair if broken. if they can’t repair it, they will issue you a check for the value of your item (original purchase price). as far as smartphones, i see that it’s a flat $125 upfront and $99 deductible. the upfront price could also be cheaper if you scour the internet for coupon codes (currently up to 40% off).

I use SquareTrade… If you buy 2 years up front you are much better off. It reduces your costs significantly. I couldn’t get insurance on my TMobile T889 for Solavei so I went this route!

Ahh, Tmo…what is happening to you? Did At&t brainwash you when they had you in their grasp?

The E4GT is going for $150-$200 on Craigslist. I don’t think the phone will drop that low. That was a bit exaggerated. LoL!!

Using your homeowners insurance is much cheaper, less than $20/year.

Yes it might be but if you file a claim there is a chance your rates will go up or they may even drop you and a lot of people don’t have that option.

Wow Chris you are really on it today….What are you really up to??!! TELL THE TRUTH SHAME THE DEVIL :p

Mobile phobe insurance is a rip off accross the board. By the time one loses their phone, with the monthly charge + deductuble, you had already paod more than the msrp is worth. If the phone drops and if it breaks, i rather just fork over the money to buy another one.

How is it a rip off? I understand if you haven’t had any problems with your phones but with most phones today being smartphones they are very expensive to fix if they break. I didn’t even break my phone once for the past year but had to take it in for manufacturer defect and without warranty it would have cost me a lot of money. Of course I had the sprint in store repair option that only cost $4 without having to pay for a replacement as long as there was no physical damage but that now is non existent so I chose best buy.

Are you kidding? Phones are incredibly cheap to repair a majority of the time. Most common damage is digitizer damage from a drop. Digitizers usually run $20 or less. I’ve changed several. It’s these rip off prices that made me learn how to fix phones myself.

It might be cheap to replace the digitizer on an evo or a galaxy s2 since they have been around for a while, but what I am talking about here is phones that are only couple months to a year old. These phones are expensive to repair not to mention most people don’t want to do it, can’t do or dont have the resources to do it. Plus just as an example, I just checked ebay and a digitizer for the note 2 costs around 260. then you have to have all the tools to repair it and the time. After all that It would have been cheaper, easier and not to mention there won’t be any mistakes to a certain degree, by just swapping it out with insurance, if you have best buy it would have only cost you whatever your paying monthly since there is no deductible.

I see what your saying about repairing phones but that really only works for older phones or at least a year old phones.

Sprint has increased the price of insurance from my current rate of $8 a month on my EVO 4G to $11 a month when I upgrade to the Note 2 later this month, but with the same deductible.

Deductible is $150 or $200 now. So in reality your paying a lot more.

I never buy insurance. It’s a racket. Cheaper to buy another phone on Craigslist or eBay.

How much is a Note 2 on CL?

Ok. Go ahead and buy a used g note 2 on craigslist. I guarantee you wont pay less than $400.

I bought square trade on my note 2 to my disappointment when I tried claiming for my galaxy s2 on T-Mobile. get this: $120 and the customer representative even said that that is not guaranteed as they’re giving out a refurbished s2 instead of a new one. wtf? I love t-mobile but they have the worst insurance ever.

I think all insurance replacement phones are refurbished. No one does new phones. Except for maybe apple but thats another story in itself.

That’s all of them. None of the carrier’s insurance companies offer a new phone. They will always offer a refurbished one.

I may have to drop my insurance in March. This is absurd.

I had a Samsung Instinct stolen from me years ago and got it replaced with insurance. My GS2 malfunctioned about a week prior to me upgrading ti the Note 2, replaced (free) under insurance/warranty since it was over 1 year old. I would be SICK if I broke or lost this thing.without insurance.

I do, $6/month or so for my htc doubleshot. I don’t like to let fate be in control.

I just cracked the screen on my gnex after a year. Wish I would have gone with square trade. Luckily its not too bad and just looks as if there’s a hair on the screen so I will survive for a while at least

What inAZ said … Some homeowners / renters insurance can add on a rider for your phone. Last a checked, a year or so ago with USAA, they didn’t.

Or Best Buy Black Tie. Getting 4 EVO LTEs on launch day for free helped offset the sting of cost. Shrug

I insure my phone for the first 9-months after I own it if its new device. Simple math really. I dont buy a new phone the first month or two after it comes out. I wait for the right time to save the most.

Ex: 32GB Galaxy S3 in September for $175. This was a GREAT price then.

9-months from now these will be available used online for less then $250. Probably less than I paid. So insuring the phone for more than it cost to replace is dumb. Im not too clumsy with my phone. A good case and screen protector and you’re in good shape to not NEED insurance.

Lost, stolen, wet or corrupt phone is another story. But then again, I dont neglect my phone, so the odds of needing any of this is pointless.

@Fuzzypaw :

BEST BUY’s GEEK SQUAD protection does not cover against lows or theft. That’s a trade-off I’m more than willing to accept in exchange for their no-hassle $0.00 deductible 100% replacement coverage. This includes water damage, which some other policies do not.

best buy. got my one s insured for $10 a month and no deductible if something happens

Sprint I think has it worst. Its $11 a month with a $200 deductible. Right now the best insurance is best buy. It costs less than $8 a month if you buy it up front for $169.99 and there is no deductible. Plus they offer a loaner phone, unlimited claims, and they also offer an app that is like seek droid but better. It takes a picture on command or when you report phone lost. So far this is the better than square trade. Square trade has a $99 deductible and you have to deal with someone by phone or mail, no walk in service. Plus I think they have a limit on claims.

I go through best buy. $10 monthly and no deductible. No matter what happened to it, the take care of it

Cool thing about having T-Mobile insurance is that you can claim malfunction/defect and get next day shipping on your replacement ANY time through T-Mobile NOT Asurion. No deductible.

Sometimes on older models, people have been known to get better phones as replacements. There is no limit on how many warranty exchanges you can do.

I had Sprint insurance($8/mo) for my EVO but never used it (of course I needed it about 2 weeks after cancelling it). I just got an S3 and looked at insurance but Sprint (Asurion) wants $11/month with a “$150 – $200” deductible. No thank you. Still thinking about SquareTrade as the rate ($7/mo + $99 deduct) seems a lot easier to swallow and I take my phone snowmobiling and such which offers significant opportunity for damage.

Sam’s Club is offering SquareTrade with new upgrades and activations. The deductible is half at $49. The only thing is that you only have 30 days to get after the purchase of the phone. I got it on mine.

I insured both my HTC Evo 4G’s for about 10 months. After that I figured I could buy one new for the same as my $100 deductible with Sprint.

Insurance is great when something breaks. If nothing breaks you are screwed out of money.

I have all my phones insured, my old g2 got replaced 5 times with glutchy refurbished models until tmobile ran out of them, so they offered a choice a free new phone with no new contract extension. the best phone offered was the sensation though.

Now I own the note 2 and it is also insured.

Mobile phone insurance is expensive. I’ve been paying for 2 smartphones for almost 2 years now. I think it started at $6.00 a month each, and I have to check but, I think its $8.00 now.

I have to say it is worth it to pay the insurance if you are like me, in the construction business, and also a little dumb at times (blonde) LOL, or if you mess with custom ROM’s.

I’ve had both of my phones, Galaxy S 2 T Mobile T-989, Galaxy S Captivate AT&T I897, replaced by Asurion, the Captivate two times, and the both S2, and Cap within the same month last year in between Xmas and the first week of January.

Sure I had to pay the deductible, it’s easier to pay $120 -$130, then to pay $400- $600.

They, (Asurion and TMo) even let me insure and replaced, my Captivate which is an AT&T phone that I unlocked and use on T-Mobile Network. So I have nothing bad to say. Every experience with Asurion was pretty painless. Except one time I got a replacement phone that didn’t work right, and Asurion sent a new one next day air.

But, that is just my experience with insurance.