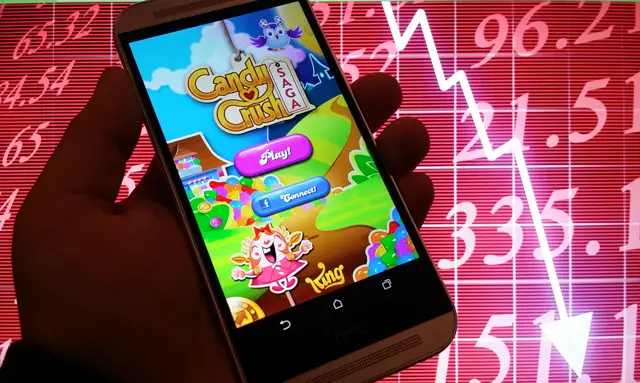

For King Digital (KING), makers of the insanely popular game Candy Crush Saga, the story gets thicker but not sweeter. The company’s Initial Public Offering was today, dropping quickly from $22.50 to $20.50 per share and eventually closing at $19- a loss of 15 percent.

The initial valuation placed the company’s worth at $7.1 billion, which if you ask me, is absolutely absurd. At the end of the day (literally) the company is still worth over $6 billion on paper. Here is my personal problem with such a high valuation:

- 2012 revenue: $164.4 million

- 2013 revenue: $1.88 billion

- 2014 revenue: TBD

For some companies, projecting future revenue based on past revenue is logical, but Candy Crush Saga won’t likely be around (or as popular) forever, so making the next big game needs to be a priority for the company. One look at Flappy Bird shows how unpredictable the mobile gaming industry can be; just as one game can quickly take flight, so can another see profits fly south for the season.

We’ve seen this with game maker Zynga, owners of popular games such as Words With Friends and Draw Something, whose stock peaked at $14.60 in 2012 and has since battled a downward spiral placing them under $5 since 2012.

There is no doubt that the gaming industry is huge and lucrative, but it can also be high risk. I imagine, with “please the stockholder” pressure on executives, they’ll be hard at work trying to create King’s next big game success. Or perhaps, like Mark Zuckerburg and Facebook, they’ll just buy it with their newfound billions.

Even companies with long and proven histories in the gaming industry find it difficult to sustain long-term success.

Look at Sony, Microsoft, and Nintendo who recently launched the PS4, Xbox One, and Wii U in hopes of capturing the next generation of consoles: the verdict is still out.

Look at companies like Electronic Arts, Glu Mobile, and Take-Two Interactive who have popular flagship brands such as Madden, Deer Hunter, and Grand Theft Auto: all of which have lower stock prices today than one decade ago.

A decade is a long-time. Being relevant in the gaming industry for a decade is a success in and of itself. What makes me think KING can be successful for the long-term? Nothing. What makes me want them to succeed? Sure as hell not this.

I don’t have an intimate understanding of King’s inner workings. I’m also not a stock market guru and you shouldn’t take anything I say as financial advice. I’m just speaking my mind, but I think I’m coming from a place of logic, and the stock market seems to agree. I think they’ll continue to agree.

Regardless of where the stock is today and where it goes, one thing is for sure: everyone involved with the company since it’s inception likely just got a ridiculously large payout.

Do you think King, Candy Crush Saga, and the games they produce in the future will continue to be successful? Where will they take the company next? And perhaps most importantly, do you even care?

No thanks. If I wanted to throw some money away I would have invested in the OUYA.

It should go lower than that. Seriously, who would invest in a one hit wonder like that.

I hope the company dies.

I hope you lose your job.

I hope you both end up homeless.

That’s not nice. I was defending jobs … and homes.

This just shows how stupid some investors are. This companies stock shouldn’t be worth $1.

Short interest should be through the roof, whenever it first shows up: http://www.nasdaq.com/symbol/king/short-interest

I am proud of the fact that I’ve never played Candy Crush Saga.

Me either.

idongach what you said.

What he said!!

+1

A company based on a one hit wonder should not even be glanced at, just way too much risk. Candy Crush is still kicking, but it’s an uphill battle with stiff competition.

This company is the next Zynga.

I can’t believe more people haven’t figured out that this game is rigged. Google “Candy Crush Rigged” and you’ll see. The game modifies which pieces drop to maximize the profit they can make on people. Whereby they make the levels more difficult based on how often you play and/or how much money you spend. Not to mention the company’s terrible business ethics.

Wow… that’s some really interesting reading. We might have to some coverage on this ourselves. Very interesting way to think about the in-app purchase strategy of mobile game devs.

Please write an article about it (if possible with other examples than just candy crush) Sounds very interesting and worth pointing out on PHandy

Seconded, would definitely enjoy an in depth look at this

type of in App baiting.

So I should buy the stock is what you’re saying

To answer Rob’s last question in the article,no I don’t care,couldn’t possibly care less.

LOL net/phone app IPOs are so stupid. One hit wonders.

Not even one, when you consider that their one was a rip off.

You mean the FREE game I play that’s only used when I’m waiting for something or on hold isn’t worth that much? Say it isn’t so…..OBVIOUS!

Ya but a lot of those so called stock market experts dont understand that because they are idiots that have no clue about how the gaming industry works.

And lets all just admit that word fued and draw something are just scrabble and pictionarie?

I hate these bastards so much…