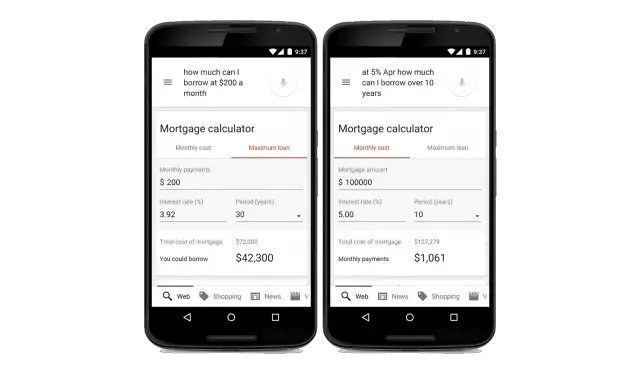

Planning on buying a house sometime soon? It’s a pretty big step and even if you’re just toying with the idea, Google is here to help. Starting today, you can now ask Google anything from “How much can I borrow at $X a month?” or “At X% APR, how much can I borrow over X years?” and Google will give you the answer.

Once you have a result, you can further play around with some of the numbers like mortgage amount, interest rate, mortgage period, and more. If audibly talking to your phone is too cumbersome, you can simply type “mortgage calculator” into Google Search and fill out each field manually (this can also be done on the desktop site). As with most things Google, it looks like the mortgage calculator in US-only (at least for now).

[Google+]

AMORT.BAS for BASICA anyone?

Wow .BAS! I was using QBASIC Instead… Thanks for the blast from the past…

Is this only available for desktop? The google search app gives me nothing.

I’m going to buy a house now just to test this out.

Me too.

I was thinking the same

Does this take into account square footage & taxes (different in every town)? Also, your tax deduction is based on your income bracket (richer deduct more…). You need all this.

What does square footage have to do with my mortgage? Also, unless you escrow taxes have nothing to do with your mortgage. You don’t need your tax deduction when calculating how much house you can afford, the bank does not look at how much money you can anticipate getting back at the end of they year, thy normally go with a ~40% DTI ratio at the high end.

Sure, you only need the sq footage for personal comparison of houses ( $$/sq ft). You’re a fool of you simply take the maximum loan you can get without figuring in the taxes and return. Assuming you put down 20% (or less) a sizeable amount of your payments will be toward interest for years… meaning a larger return. As your equity increases, your return goes down.

If you are trying to decide whether to “buy or rent” you add in taxes & insurance to the mortgage payments, add one-time closing costs, subtract out your return, and then compare that to your equivalent rent. If you don’t plan on staying in your town a long time you *might* be better off renting.

You ARE better off renting if you don’t plan on staying a long time, unless you plan on renting out your home when you move, though then you’d need to hire a property manager and a real estate agent.

And then where do you get the downpayment for the next house if you haven’t/can’t sold/sell the first house?

This is a critical part of the housing crisis that trapped people in their homes.

You rent until you know the new town you’ve moved into, by then you should have a tenant and good income from your investment, get a FHA or USDA loan one of which requires 3.5 down the other which allows a LTV of 102%

So in that time in between you’re paying both rent and a mortgage. Once again, most people can’t afford that. You’re also assuming the rent fully covers the mortgage and taxes. Often times mortgage payments are much higher than the average or high-end monthly rent.

I’m all for investing, but you’re over trivializing the *risk* of signing up for these massive loans.

I got an FHA loan and my PITI is less than my neighbors who rent pay a month, that includes the $150 I pay the FHA a month.

People don’t buy investment properties to charge their tenants less than they pay.

I also want recommending buying if you’re moving soon, unless you want the investment property and headache that goes with it.

There are lots of variables in that statement :-)

It depends on 1) your real estate market/region, 2) the quality of your rental, and 3) the quality of your purchase.

Also, we weren’t talking about investment properties, but simply how to pay for your primary home.

If you’re not looking to keep it as an investment buying a house you won’t live in for at least 5 years is a waste if money.

Once again, this is what i was advocating calculating with an app. I already have a pretty intense spreadsheet for this. “5” is an arbitrary number you just pulled out of your arse :)

If you live in a metro region where quality homes sell quickly, and prices rise yearly, then “5” can become smaller …

It’s a quick Google search, not an in depth financial guidance. You are expecting way too much out of this.