MetroPCS will vote on T-Mobile deal March 28th

While the proposed acquisition of MetroPCS by T-Mobile isn’t getting nearly as much attention as that of T-Mobile’s failed acquisition by AT&T, it’s still of interest to us. MetroPCS has revealed that shareholders would get together and vote on the issue March 28th. The two parties still need to pass regulatory hurdles, which include the usual song and dance of anti-regulatory investigations and other boring legal processes. There’s not much reason to believe the government will play a part in blocking the deal, though.

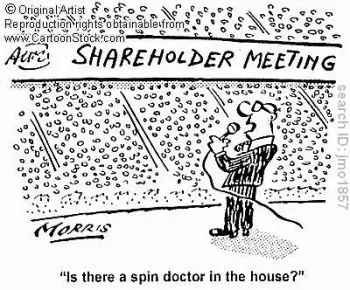

The biggest problem stands to be the very shareholders who will punch their tickets late next month. It’s said that two of Metro’s major investors — hedge funds Paulson & Co. and P. Schoenfeld — are looking to vote against the deal, with doubts about proper valuation on Deutsche Telekom’s part. The two control a combined 11% of MetroPCS, and would certainly look to get more shareholders on board with votes to block the deal.

As it stands, T-Mobile would merge into MetroPCS’ current standing as a publicly traded company, and Deutsche Telekom would then get 74% of the combined companies. The remaining 26% of the company, as well as $1.5 billion, would be given to shareholders. I won’t pretend to know if MetroPCS is worth more or less than that, but if it’s not good enough for the millionaires and billionaires who own the company then who am I to argue? We’ll be keeping a close eye on this one as March quickly approaches.

[via Marketwatch]