Squirreling away an emergency fund can be hard when you’re living paycheck to paycheck. That’s why these apps aim to make it easier to save by treating your savings like just another expense. Some of these services are entirely flexible and let you set up your own savings plans with special rules, while others will round off the difference from transactions you already make to save those pennies.

Here’s a peek at 10 apps that will help you automate your savings and before you know it, you’ll have a fat stack of cash.

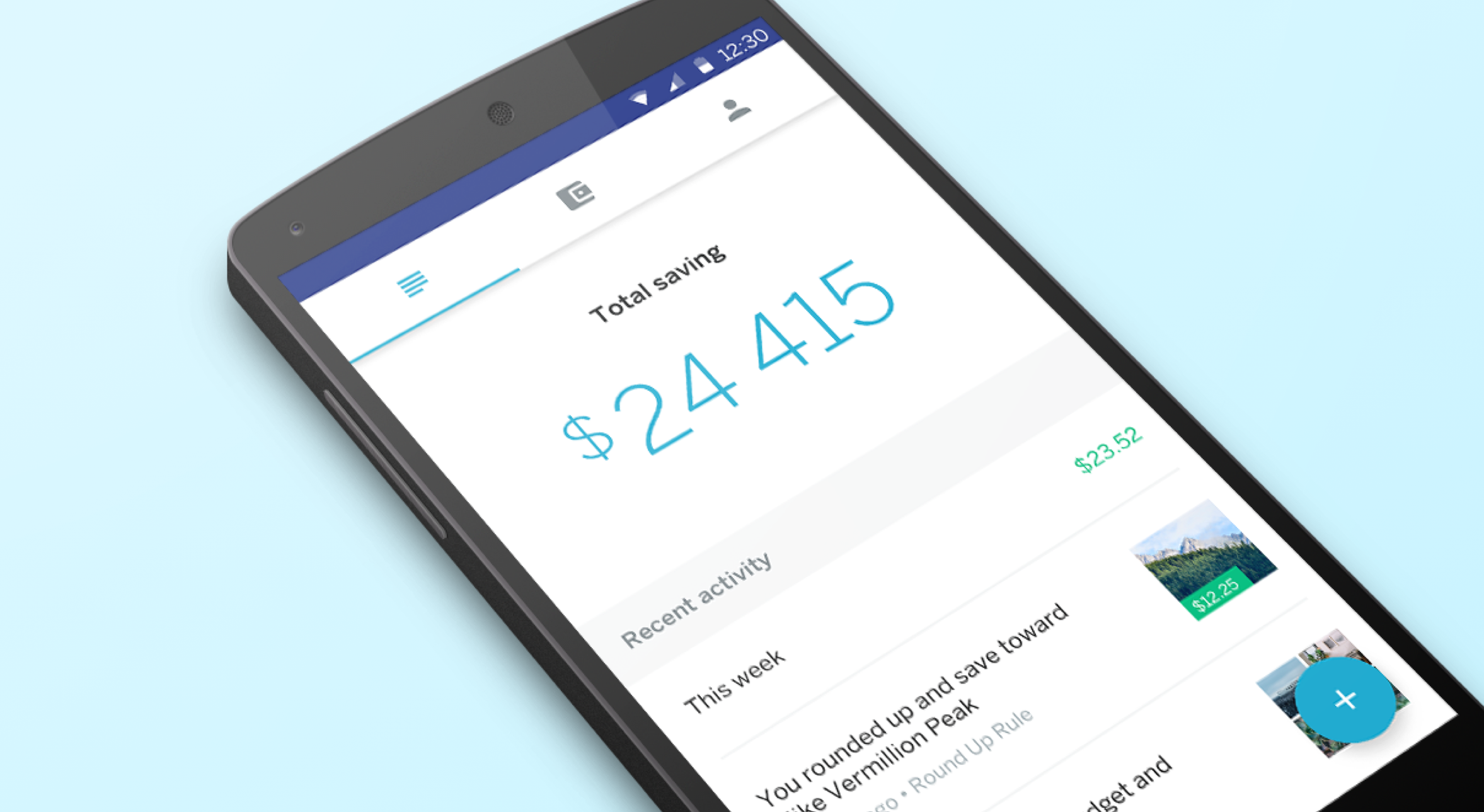

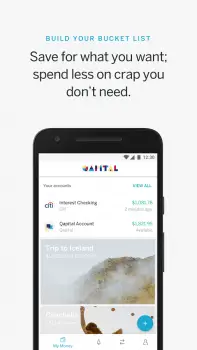

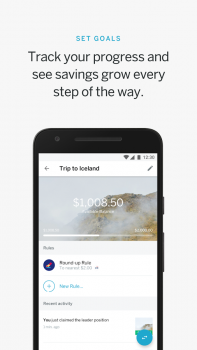

1. Qapital

Best For: Setting goals and customized savings plans

Price: Free

In-App Purchases: No

Qapital is the most customizable automated savings app because it hooks into IFTTT to let you set up your own goals. You can pay yourself every time you hit your step goal on Fitbit. You can save the change from any transactions you make. You can even pay yourself when you finish a task to incentivize yourself to get it finished.

The customization options for Qapital are endless thanks to IFTTT and its recipe system, so you can save money for just about anything. The only real downside to Qapital is that your savings account doesn’t earn interest unless you sign up for their beta checking account program. However, using Qapital’s extensive rules and transferring the savings to higher yield savings account is also one way to take advantage of Qapital and still earn interest.

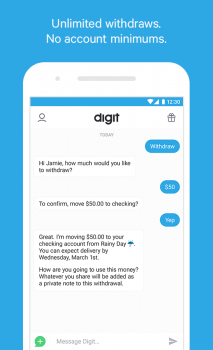

2.Digit

Best For: Highest interest returns on savings*

Price: $2.99 monthly

In-App Purchases: Yes

Digit started out as a way to squirrel away spare change from every single transaction through your linked bank account. They launched in 2015 as a free platform, but last year decided to start charging $2.99 a month for their service. Previously you earned an annual interest rate of 0.2% on your savings balance with Digit, but with the new monthly fee that’s been bumped up to 1%.

Even still, you’ll need to keep $3,600 a month* in your account in order to break even with the new interest rate. Their automated savings bot can help you save up for goals that work similarly to Qapital, but in my experience, Digit’s algorithm for detecting whether or not a transaction will cause you to be overdrawn is not as robust.

I started using Digit when it first launched and during that time until a few months ago, I experienced 3 overdraft charges (which Digit covered) and decided not to continue using it. Your mileage may vary, but I was not pleased with my experience, especially when so many others on this list are free.

3. Dobot

Best For: Alternative to Digit

Price: $1.99 monthly

In-App Purchases: Yes

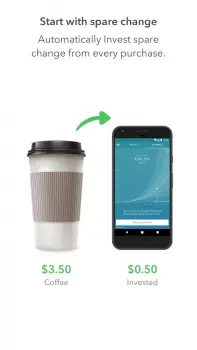

Dobot operates much the same as Digit does, with the ability to specify goals you want to build savings toward. It takes the left over .45 cents after your morning coffee and every other purchase and saves it toward the goals, thereby taking the money you wouldn’t have missed anyway and saving it.

The big draw to the service used to be that it was still free after Digit started charging, but last month the company sent an email to those who use the service to let them know they’ll be charging $1.99 a month. By doing so, Dobot has made itself a worse option than Digit, since it is now charging you a fee for the service and not giving you any interest on the money held. Sure, it’s only $25 a year to use Dobot, but it’s still not as robust as Qapital and that’s free.

4. Acorns

Best For: Those who want to invest their pennies

Price: $1 monthly for accounts under $5K, $0.25% per year for more than $5K

In-App Purchases: Yes

Acorns takes a different strategy with squirreling away money by investing it in ETF funds that Acorns recommends. It features the same concept of taking the rounded up change from your everyday purchases, but it also allows you to set aside a set amount either weekly or monthly to fund your account.

Because Acorns is investing the money in this account, there’s always some risk associated with using the app. It’s not a flat savings account and it’s possible to lose money. But on the flipside, it’s also possible to earn more money than you invested. If you’re not risk-averse and you’re fine with how the market fluctuates, this can be a good way to get started with savings that can earn more over time.

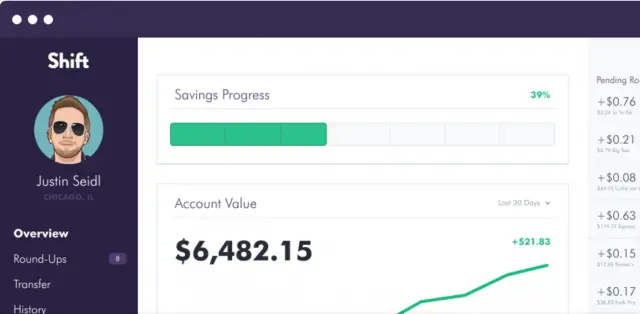

5.Shift

Best For: Completely free round up saving

Price: Free

In-App Purchases: No

Shift allows you to save your rounded up transactions much like Digit and Dobot, but it’s still completely free. The only downside to Shift is that the iOS and Android apps are still in beta development, so right now you can only manage your Shift account through their website.

It’s a bit archaic in the age of managing your extra funds through an AI chat bot, but if you prefer the good old fashioned web page for viewing all your savings and goals, this might be the service for you. Shift says the apps for both iOS and Android should be arriving soon.

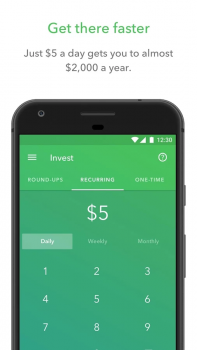

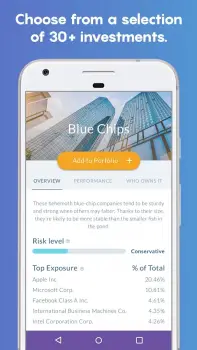

6. Stash Invest

Best For: Alternative to Acorns investing

Price: $1 monthly or $0.25% per year over $5K

In-App Purchases: Yes

The only real downside to Acorns is that it doesn’t allow you to pick where your money is invested. That’s an oversight that Stash Invest remedies by giving you over 30 different options to chose from with a mix of different stocks in a variety of sectors. It doesn’t allow you to invest your spare change like Acorns, but for as little as $5 you can start setting aside funds that have the potential to earn you returns on your money.

The fees associated with Stash as the same as those found in Acorns, just with more control over where your money is invested.

More Best Apps & Games

Our Download This series includes the best apps and games you should be downloading. We also have more lists for the best apps and games on Android. Check them out below!

- 100 Best Android Apps

- Best Android Apps for learning languages

- Best Android apps for college students

- Best Android Games for Killing Time

- Most Addictive Android Games of 2016

- Reader-voted best apps