Sometimes, we need that little jolt to get us back on track; that extra cash can make all the difference. Loans can be your saving grace when emergency expenses stare you down and there are no savings in sight to help you out of that shameful financial situation. But applying for loans comes with its own attendant risks, one of which is a dip in your credit score due to hard credit inquiries.

On top of that, there is little to no guarantee you will be approved for the loan. Approval decisions may take days too. What if we told you that there are instant-approval payday loans with no credit checks? There’d still be the problem of locating them right? Well, maybe not. And that’s because we have highlighted the best resources for these kinds of loans here. Check them out.

List of Best Payday Loans Online With No Credit Check & Instant Approval

- WeLoans – Best overall

- iPaydayLoans – Best for Building Credit

- CocoLoan – Best for Competitively Low-Interest Rates

- CashAdvance – Best for Medium-Sized Loans

WeLoans

WeLoans is king in the payday loans online with no credit check and instant approval community. WeLoans’ partner lenders have a relaxed screening process. Their evaluation of an applicant’s creditworthiness is more focused on the applicant’s debt-to-income ratio, spending history, income and how long they’ve been at their current job than their credit score. Therefore, their approval rate is at a market-high (98%).

These lenders may report payments to the three major credit bureaus, but do not consult these bureaus in their assessment of the borrower’s creditworthiness. They run only soft credit inquiries and make approval decisions in under five minutes.

Pros

- Offers joint signing

- Loans can be secured with assets like a car title

- Funding decisions are made in under five minutes

- The application is straightforward, and its form can be completed in as little as three minutes

- Prepayment penalties do not apply

- Extensive network of reliable and licensed lenders

Cons

- Borrowers without a credible source of income may not qualify for a loan

Hard Credit Inquiries Are A No-No With WeLoans. Apply For A Loan Now!>>

iPaydayLoans

iPaydayLoans is another big player in the no credit check loans lender circle. What makes this lending service indeed special among its peers is the wide range of loan offers it has available to borrowers. The highly-rated lending service has loan offers even for unemployed folks. You can qualify for a payday loan with iPaydayLoans if unemployed, so far you have a consistent source of income. That is, unemployed people who enjoy benefits can take advantage of this offer.

iPaydayLoans is closely behind WeLoans on approval rates; with only a marginal difference. They also offer high loan amounts, up to $5000 payday loans and $35000 personal loans. The best part is the borrower isn’t subjected to hard credit inquiries during the application process.

Pros

- Loan approval rate is about 97% and higher

- Zero origination or processing fees

- The platform is safe and secure

- Competitively low APRs

- Payments are reported to TransUnion, Experian and Equifax

Cons

- Doesn’t have a mobile application

Build Your Credit With No Credit Check Payday Loans With iPaydayLoans>>

CocoLoan

CocoLoan, a customer-centric lending service is one instant approval lending service you should be looking to try if you are new to online loans. They have stand-by customer support that works round the clock, resolving complaint tickets and providing detailed answers to pressing questions you may have.

Like many others on this list, the application process is pretty straightforward, and its approval decisions are near-instant. Borrowers can access up to $5000 and have a repayment schedule of up to 24 months.

Pros

- Excellent customer support

- Competitively low-interest rates, about the industry average

- Platform has a lot of loan offers including personal and no credit check loans

- Approval decisions are made in under five minutes

Cons

- Late payment fees apply

Get Started With CocoLoan’s Easy Application Process Today>>

CashAdvance

CashAdvance is hands-down the most reliable loan service, and one of the best no credit loans providers in the US. It provides users with loans of $100 to $10000 without digging too deep into their credit reports. That is, its partner lenders do not run hard credit inquiries on prospective borrowers.

CashAdvance has no minimum credit score requirement for a loan. Therefore, your chances of getting approved are very high, almost guaranteed, as long as you meet the basic eligibility requirements. Borrowers may use CashAdvance’s loan calculator to estimate potential interest rates, fees, and monthly payments to be made before applying for the loan. This gives them a clearer picture of the potential cost of the loan they are about to obtain.

Pros

- It is totally free to use; no subscription plans

- Can potentially build borrower’s credit by reporting payments to the major credit bureaus

- No minimum credit score requirement

- The website has a calculator to help borrowers determine interest rates and fees ahead of pre-application

- Customer-centric

- Bad credit loans are also available

Cons

- Has no mobile app

Increase Your Chances of Getting Approved for a Loan With CashAdvance>>

Payoff

Payoff, now more recently known as HappyMoney, is a great no-credit-check payday loan service for people looking to consolidate their credit card debts. However, they consider more than credit score in their assessment of a borrower’s application. They may also factor in the borrower’s debt-to-income ratio and credit utilization.

The borrowed amounts usually range between $5000 and $40000. A major edge over its competitors is its zero late payment fee policy. Loan defaulters aren’t charged for paying late. Prepayment penalties do not apply either. Users can also check their interest rates pre-application for free and without any risks to their credit scores.

Pros

- Zero prepayment or late fees

- Competitively low APR

- Borrowers’ eligibility requirements are clearly spelled out

- Available in nearly all states asides from Massachusetts and Nevada

Cons

- Charges origination fees between 0% and 5% of the total loan amount

- Does not offer joint application with co-signers

Get Instant Cash to Pay Off Your Credit Card Debts With Payoff>>

CashUSA

CashUSA is arguably the best loan resource for newcomers to the no credit check loans clime. It has a rich database of resources to help newbies get acquainted with the borrowing process. Here, you will find educational resources on obtaining loans, how to improve your credit score and managing your finances in general. The online marketplace also has a wide, extensive network of lenders consisting of both state and tribal lenders.

People who have had trouble paying on time in the past have testified to the openness and willingness of lenders to renegotiate payment deadlines before deploying debt collection measures. Oftentimes, the APR is usually within the 5.99% to 35.99% range depending on the lender’s assessment of your application.

Pros

- Accommodates state and tribal lenders in its network

- Lenders are open to an extension of payment deadlines

- Bad credit borrowers are considered too

- The application form can be completed in under five minutes

Cons

- Loans may be inaccessible to unemployed applicants because of the minimum income requirement

Reach CashUSA’s Borrower-Centric Partner Lenders to Get a Loan>>

Wiser Advisor

You know what’s disastrous about taking out a no credit check payday loan? Not having an actionable plan to work with! Wiser Advisor protects your financial interests and helps you stay on top of your finances by connecting you with financial advisors. These advisors chosen based on their experience, advisor compensations, and licensing and disclosures with SEC/FINRA will tell you how best to use this money to improve your financial health and make you more financially stable in the long-term.

The service, rated 4.1 out of 5 on TrustPilot, has a helpful database featuring articles on financial planning, saving, taxes, estate planning and retirement. The service also has a number of financial calculators to help you better strategize for retirement and choose the right IRA.

Pros

- Initial consultation is free

- Financial advisors in its network are licensed and have disclosures with SEC

- Has financial calculators to help with estimating inflation effects or even choosing the right IRA

- It is customer-centric, hence it has A+ rating on Better Business Bureau

- Has a helpful blog on financial planning and management in general

Cons

- Many do not have financial professionals in a few particular areas

Get The Best Investment Consultations Courtesy of WiserAdvisor>>

Quicken

Quicken helps people reach their financial goals by providing them with a trove of budgeting and finance management tools. Obtained a no-credit-check and instant-approval payday loan yet? You can make actionable plans on how to pay down your debt using Quicken. This finance solution also helps you make the most of the cash by suggesting investment opportunities and creating budgets to avoid careless spending. What’s more? You can track utility bills and make payments using the app.

Lots of users give it a huge thumbs up for the ability (optional) to synchronize it with your bank accounts. Many users testify to how easy it is to use too. Before now, you had to download the solution to use on your device. However, its latest incarnation can be operated as an online-only solution if you like. This makes it accessible on the go.

Pros

- Works on a variety of operating systems

- Can be synced with one’s bank account

- Clean UI

- Feature-loaded

- Has a setup wizard to help you learn quickly

- Active user community to help with learning

Cons

- It costs more than a one-time expense since you need to pay for new licenses when new versions come up

Manage Your Budget and Track Your Investments Using Quicken>>

Speedy Cash

Speedy Cash is an increasingly popular choice among people who need payday loans worth a few ten thousand dollars. The platform can connect borrowers to lenders who can provide them with no credit checks and instant approval payday loans between $50 and $26000. Speedy Cash, unlike many online lenders, has physical stores too. This makes them highly trusted across different borrowers’ demographics.

This lending service established over two decades ago is also a top choice among many because of its incredible customer support. You can make complaints over email, phone or physically, at the store. One edge it has over alternatives is the availability of its mobile app. Borrowers can apply for a loan via this free-to-use mobile app, online, at a walk-in-store, and even over the phone. This convenience is unparalleled.

Pros

- Online and in-store lending service

- Has several no credit check loans asides payday loans, including installment loans, personal, title loans

Cons

- Not available in every state in the US

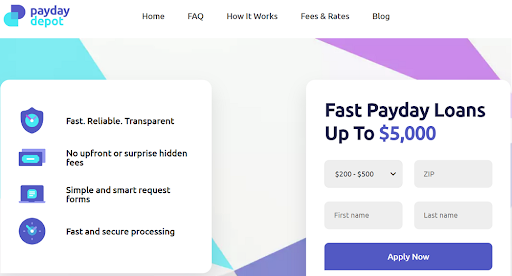

Payday Depot

Payday Depot is bursting with many payday loan options for borrowers who need urgent cash to sort out a few money issues before their next paycheck comes in. Do not get distracted by the glossy ads of lenders that fail to consider your options. Payday Depot gives you access to some of the best payday loans online with no credit check deals at competitively low interest rates.

Borrowers can apply for loans up to $5000 on Payday Depot at no cost, depending on the state’s lending laws. The application process is pretty swift and the approval process is near-instant. More importantly, they report on-time payments to the major credit bureaus, which affords bad credit borrowers a good opportunity to build their credit.

Pros

- Lenders run only soft credit inquiries on borrowers’ profile

- Loan is processed in very few hours

- Competitively low-interest rates

Cons

- Late payment fees may apply once a borrower defaults on payment

Do Instant-Approval Payday Loans With No Credit Check Really Exist?

Yes, they do. But not in the exact sense you may have presumed. Here’s the crux of the matter. Credit checks are recommended by the CFPB and other US financial regulators, hence, cannot be totally avoided. However, hard credit inquiries used by some lenders to review a borrower’s creditworthiness often cause a dip in the borrower’s credit score. If this credit score is low, the borrower may be sidelined and their loan request dismissed.

To avoid this, a few other lenders run only soft credit checks, which satisfy the requirements of these regulators but do not put the borrower at a disadvantage while at it. Also, the borrower may be approved for a loan even if their credit rating is poor.

Therefore, soft credit checks are as good as no credit checks. Thus, payday loans approved on running these credit checks are what’s advertised as instant-approval payday loans with no credit check.

How Can I Take out Payday Loans Online With Instant Approval?

There are two options or routes to consider. One is shopping around for lenders and the best offers available on your own and the other, allowing a loan broker to do this for you. The major difference between both options is locating a lender. With the former, you shop for lenders yourself, then apply, while in the latter, the broker connects you with the best deal and you carry on with the application from there.

Once, you are done with the hard part of choosing lenders. Prepare all necessary documentation like proof of income, and government-issued ID needed for the application. Then, fill out the application form, submit it, and wait for approval, then funding, if approved. Funding is usually processed within the same day or the next business day after approval.

Alternatives to Online Payday Loans No Credit Check

There are a few other loans you can get without a hard credit check; they are:

Bad credit loans

Bad credit loans are loan offers designed or set up for people in the bad credit category, that is, when the borrower’s FICO score is less than 580 (on a scale of 300 to 850). In light of the difficulty of obtaining loans when you have a bad credit score, a bad credit loan may be a viable option to help you with your financial situation.

Installment loans

Installment loans give you a lot more time to repay your debt. By spreading the total cost of the loan evenly over a period, usually 24 to 72 months, repaying feels less burdensome. They may also be unsecured or secured with collateral. As expected, a secured installment loan attracts lower interest rates compared to an unsecured one.

Title loans

Borrowers who own a car may choose to secure a loan using it. Turning in your car title as collateral helps you beat down the interest rate. It may also help you in borrowing only what you can afford since car title loans usually only qualify you for 25% to 50% of the car’s value. Your credit score matters little when obtaining a title loan.

Other Ways to Address a Temporary Cash Crunch

Have your utility bills shot up by more than half with no paycheck increase to accommodate the local inflation? Getting a loan can help you sort out these bills, especially when they are already long overdue and you risk being cut off. However, this is only a short-term solution. You can address your money problems using other quick ways of getting money like;

- selling old, unused items in your store;

- freelancing on online marketplace like Fiverr and Upwork;

- registering as a driver on ride-hailing services like Uber and Lyft;

- delivering groceries for big e-commerce stores like Amazon;

- selling course notes on sites like Stuvia and Nexus Notes;

- and renting out your parking space on Parklet and Just Park if you live in a busy part of town.

Conclusion

Avoid potential credit score hits by applying for a loan via any of the lending services highlighted here. We’ve done the hard work of cherry-picking from what’s available. However, the onus is still on you to make a selection based on what’s being discussed. If you still have a hard time choosing one out of these options, you may consider sticking to our best overall pick – WeLoans. You never go wrong with WeLoans!

Comments