Regardless of where you live, motor vehicles are likely to be subject to collision, theft, arson, and several forms of damage. But a car insurance policy can help you remedy the harsh financial effects of these events.

So, you’ll need a car insurance premium to secure your pockets against the large amounts of spending you may have to go through if your vehicle faces any mishap. The best way to get the best auto insurance policy is to apply for car insurance quotes.

mInsurance is a company that makes receiving and comparing cheap car insurance quotes easy. Read through this post for all the information you’ll need to get quotes as well as the perks of choosing the insurance comparison tool.

mInsurance: What Does It Do?

mInsurance is an auto insurance comparison site allowing car owners to request insurance quotes, compare them, and opt for favorable policies. mInsurance allows interested car owners to apply for and get insurance rates from companies across the country.

The insurance comparison process on mInsurance is completely online for free. No matter what your vehicle model or type is, mInsurance can assist you to find quotes from trustworthy insurers and when you choose the most affordable option, you can save greatly on your insurance costs.

What’s more? mInsurance also provides up-to-date insurance tips and car guides for customers on its website, for example, procedures for car insurance claims. For further information, visit mInsurance based on your needs.

What Are the Advantage of Choosing mInsurance for Car Insurance Quotes?

mInsurance is one of the most reputable brokers in the US vehicle insurance market. As a result, customers stand a chance to enjoy a whole lot of perks when they choose to compare auto insurance quotes through the service.

Below are some of the most significant benefits of choosing mInsurance to get your car insurance quotes.

Access to Cheap Insurance Rates

mInsurance aims to help car owners save on their insurance rates in the US. The broker provides a broad range of affordable quotes, which allows you to compare and select the cheapest insurance option. That way, you will cut back on your auto insurance spending.

Swift Application Process

It only takes a few minutes to apply for and compare quotes on the mInsurance platform. You simply need to supply some personal details and provide information about your car to get auto insurance quotes.

Large Network of Insurers

mInsurance does not directly offer insurance plans. Instead, it cooperates with dozens of top-rated insurers across the country. That way, mInsurance allows you to access quotes from insurers in your locality.

Information Encryption and Privacy

mInsurance protects your information using bank-level security encryption technology. That way, it would be impossible for unauthorized third parties to access information about you or your car.

What Kind of Information Will mInsurance Ask for?

mInsurance’s partner insurers require some information before they can create tailored auto insurance quotes that will suit your vehicle and driving needs. Here are five such details that you must provide before receiving quotes.

Personal and Contact Information

To ensure you receive personalized auto insurance quotes, they ask for some personal details such as age, gender, and marital status. You should also provide your mobile number, email and residential address to receive updates and offers about auto insurance in your location.

Vehicle Details

Since insurance policies differ by vehicle, they require you to fill in the type, make, model and year of manufacture of your vehicle. Also, if you’re seeking quotes for multiple cars, you may need to provide the details of each one when prompted.

Car Usage History

You are also required to make full disclosure about the usage levels of your vehicle. This includes indicating if the car is for commercial or private use, as well as providing information about the vehicle’s annual mileage.

Driving Records

If you have been involved in an accident, or charged with a DUI offense in the last three years, mInsurance requires that you provide information about these records. This way, insurers can determine your potential risk as a driver.

Can We Get Car Insurance Quotes from mInsurance Regardless of Car Makes?

One of the distinctive features of mInsurance is that its comparison tool caters to different types of car owners. Thanks to its comprehensive reach of automobile insurers, the platform can provide quote comparison services regardless of your type of vehicle.

The insurance broker accepts different vehicle models and makes, including Bentley, Cadillac, Jeep, and Toyota cars. You can read about the special offers available for your type of car through resource articles available on the mInsurance website.

How to Compare Auto Insurance Quotes with mInsurance?

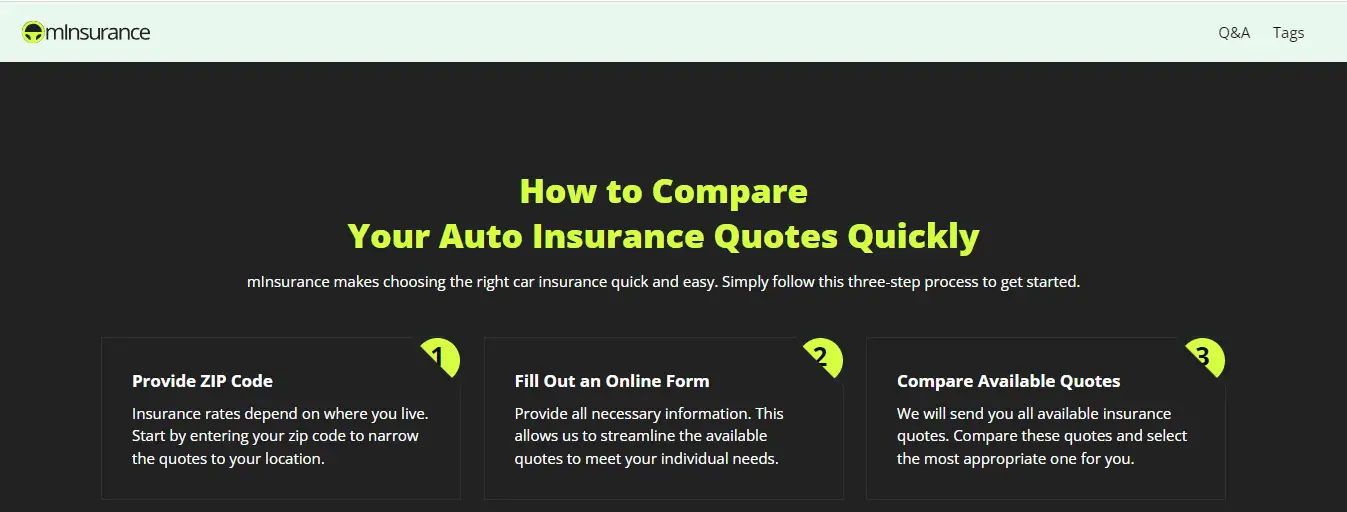

The process of receiving and comparing car insurance quotes through mInsurance is fully online and very seamless. In three simple steps, you can get quotes from insurers in your location and choose the most suitable insurance policy for your vehicle.

Type in Your ZIP Code

Car insurance is usually location-specific. So, you’ll need to provide your ZIP code to allow mInsurance to source for insurance quotes within your city.

Complete the Online Form

You also have to fill out an online form on the mInsurance website. There, you need to provide all the important details about yourself and your car.

Receive and Compare Quotes

mInsurance will send your details to their partner insurers who will reply with quotes specially curated for your vehicle. Compare these quotes and select the most suitable option for you.

Conclusion

mInsurance is a fast-rising auto insurance broker which has already built a reputation as one of the most reputable sites for comparing quotes. It allows customers to connect with trustworthy insurers very easily and receive affordable car insurance rates.

If you’re looking for insurance quotes for a car, it is an ideal choice to get access to some of the best insurance rates on mInsurance and save your budget.

Comments