There are a lot of great new features in Android M but perhaps the most useful is Android Pay. Not to be confused with Google Wallet, Android Pay is actually a Google-Wallet compatible API that lets developers build a streamlined and trusted payment system directly into their app. For Android users this makes paying for goods – whether at a physical store in a new app – easier than ever before.

Android Pay: Tap to pay in stores

Here’s an example of using Android Pay in the real world, in this case, to purchase a beverage from a vending machine.

Deal lovers will absolutely love one piece core piece of Android Pay functionality:

Also, with select retailers, your loyalty programs and special offers will be automatically applied at checkout. For example, when you tap to buy a Coke at a vending machine, your MyCokeRewards will be automatically applied. With Android Pay the contactless terminal not only receives your payment info, but also your loyalty programs and offers.

All those hard earned rewards points might finally get redeemed before they expire!

Android Pay: Tap to pay in apps

But perhaps the coolest part of Android M is the ability for developers to build Android Pay directly into their app, allowing developers to build a native store directly into the experience for Android users. In this next video, we see how one app – Wish – integrates Android Pay directly into the UI flow.

I know: all of that happened so fast. Let’s rewind it back and see those details in slow motion.

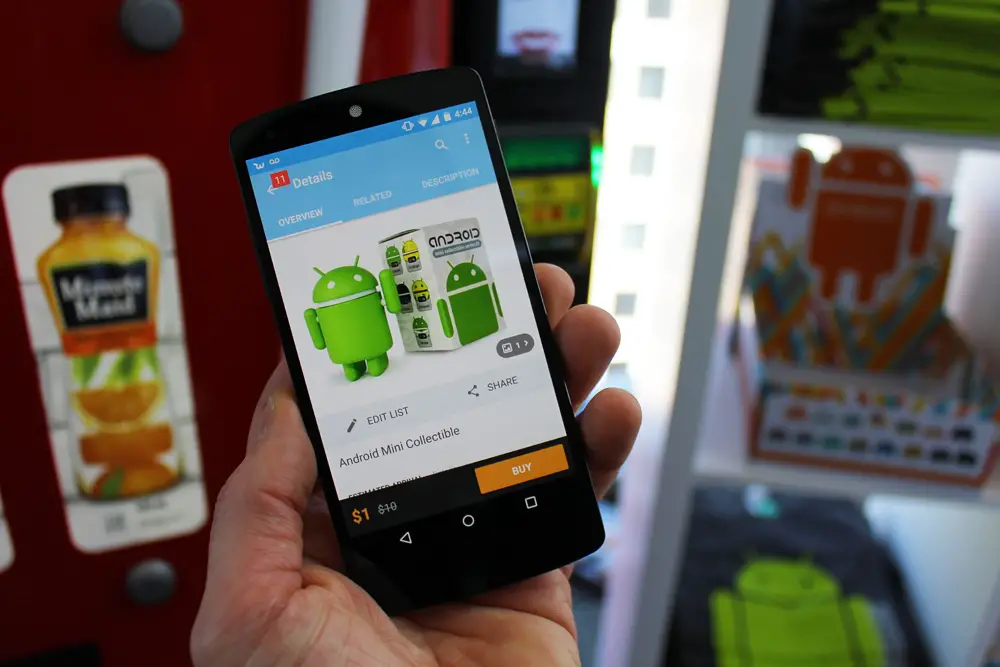

From the home screen, we tap on the Wish app icon, one of the only apps to initially support Android Pay.

Then app pops open and you’ll notice the active tab is “Google I/O”; this is a special tab created especially for this custom Android Pay experience. All Android developers will have access to creating these same type of instances.

This live demo allows us to purchase two different items:

- Android Mini Collectible

- Android T-Shirt

I went ahead and decided to buy the Android Mini Collectible, hoping to get lucky and open the box to find one of the rare versions that are selling for hundreds on eBay (and no, I wouldn’t sell it).

The beautifully material designed product page has a clean “BUY” button in the bottom right that we go ahead and tap.

And now we’ve got our checkout options including a “Buy with pay” button (where the magic happens).

Even though we’ve never used this app before, our credit card details are automagically selected from our Android Pay profile to simply select the proper card/address and continue on.

One last chance to make sure we’ve got all the purchase details correct, tap to place order, and we’re done. Android Pay makes purchases easy – even the very first time – regardless of the location or app (so long as it supports Android Pay).

Now I know you’re probably asking yourself two questions:

- Is this secure? I don’t want my credit card details getting stolen!

- Where can I use Android Pay?

Let’s get those questions answered.

Is Android Pay Secure?

Directly from Google themselves:

So when you shop at a store, Android Pay won’t send your actual credit or debit card number with your payment. Instead we’ll use a virtual account number to represent your account information — providing you with an extra layer of security. And if your phone is ever lost or stolen, simply use Android Device Manager to instantly lock your device from anywhere, secure it with a new password or even wipe it clean of your personal information.

Lending further confidence to the platform are some well-known financial institutions who are vouching for Android Pay: American Express, Discover, MasterCard, VISA, Bank of America, Capital One, Chase, Citi, Navy Federal Credit Union, PNC, Regions, USAA, and US Bank.

Where can I use Android Pay?

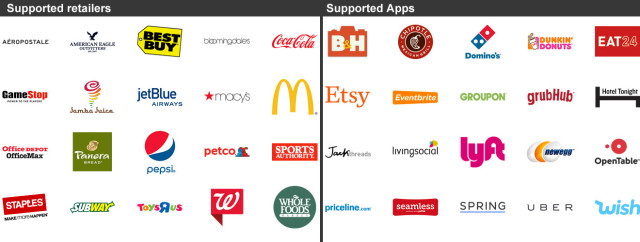

The tech enthusiast in us wants Android Pay to be available everywhere immediately, but the reality is that there is a lot of money at stake and business is business. The politics and partnerships will take awhile to pan out, but even before that dust settles, Android Pay has a healthy amount of participating stores and apps.

There are some biggies in there although it’s fair to point out the notable omission of Starbucks.

As for when you’ll be able to start using Android Pay? That’ll happen later this year once we know what Android M means and we see it released into the wild on its very first devices.

So you have to unlock the phone before you can use Android Pay? Is that only because that device didn’t have a fingerprint scanner on it? Did Google mention if Android Pay functionality would be added to Android Wear (similar to how the Apple Watch works)?

It would make very easy for somebody to use your phone to purchase some thing if they could just pick it and use it.

Right, which is why I am wondering if this was only setup this way because the device doesn’t have a finger print scanner.

If you don’t want to unlock, you can always set the “Lock” to None.. and I guess you can do the android pay “without unlocking” your phone (as it’s not locked :p)

that would be awesome if it worked with android wear I have yet to buy a smartwatch but at my job I’m not allowed to bring phones into the building for reasons but they do allow smart watches. We do have vending machines with the readers everywhere the only place I can use it is in the one one break room before the security gates

I see Wells Fargo isn’t on that list – those bastards wont stop spamming me with their Apple Pay shenanigans.

Yeah I know right?

I’m glad to see Bank of America on there, I was getting their rotten Apples for a bit.

Wasn’t Bank of America one of the scumbag companies that were intimately involved with and afterwards bailed out of the financial crisis of 2008? That bank and many others should have ceased to exist after what they did.

Well that’s one way to be #2 in the USA.

Built in loyalty might make me actually use this thing instead of the cash that I currently use.

biggest thing for me would be able to use it with the vending machines that used soft card. I i see coke and Pepsi on the list so hopeful at least those one will work.

I’ve never had a problem using Wallet on vending machines with a SoftCard logo.

Well, I had a problem once, but I just went to the next machine over and it worked, so I think that was an issue with the reader.

using Google Wallet? interesting. As far as a know all the vending machines I’ve tried, don’t accept mastercard debt, but work fine with visa debt. Being that the Google wallet physical card is a MasterCard debt i figured that might have at least something to do with it. The machines at atleast one place, also failed for people using their regular mastercard debt bank cards too. I wonder if your phone/sim/carrier might have something to do with it too, since i know at least at one point for t-mobile you could get a soft card enabled sim.

Now if only Android, Apple, and Samsung pay can finally stab currentC through the heart. Every time nfc fails at cvs and home depot and 7-11 a part of me wants to rip their readers off the counter.

I still fail to see how Android Pay is any different than Google Wallet today. I wish they would have tried pushing Wallet again rather than rebranding.

I wish they had rebranded it years ago, it was too confusing for non tech people to understand nfc was different then rest of wallet. Google wallet encompassed too many different ways to use it originally with wallet cards and stuff

It’s always surprising to me that nobody uses NFC despite its potential. You can instantly share and copy pictures to people as well as do a bunch of other cool things.

It’s absolutely exactly the same. Even the online shopping checkout with Google wallet has been available for years. The only new cool thing I see is the reward points automatically showing up

The interface is more polished lol, that’s basicly the only difference.

So long story short you just hit the checkmark lol.