In case you almost missed it (we wouldn’t blame you if you did) today actually marks the 10 year anniversary of Google’s IPO. Although one of the most influential companies the world has ever seen, things got off to a bit of a rocky start back on August 19th, 2004, the day Google officially went public.

Still seen by many as a one trick pony, Google seemingly only had one product to sell: search. This is largely what lead to an initial public offering of 19.6 million shares at the price of $85 a share, still a success, but short of Google’s original $108-$135 estimate. In his 2004 post, value investor Whitney Tilson didn’t believe Google had staying power saying:

“Just as Google came out of nowhere to unseat Yahoo! as the leading search engine, so might another company do this to Google… I am quite certain that there is only a fairly shallow, narrow moat around its business.”

But as we all learned, archiving the internet and all of its data would later prove to be more lucrative than anyone would guess, and although selling ads is still Google’s bread and butter, we’re seeing the internet search giant branch out into software development (Android, Chrome OS) and even more recently, dabbling into robotics and self-driving cars.

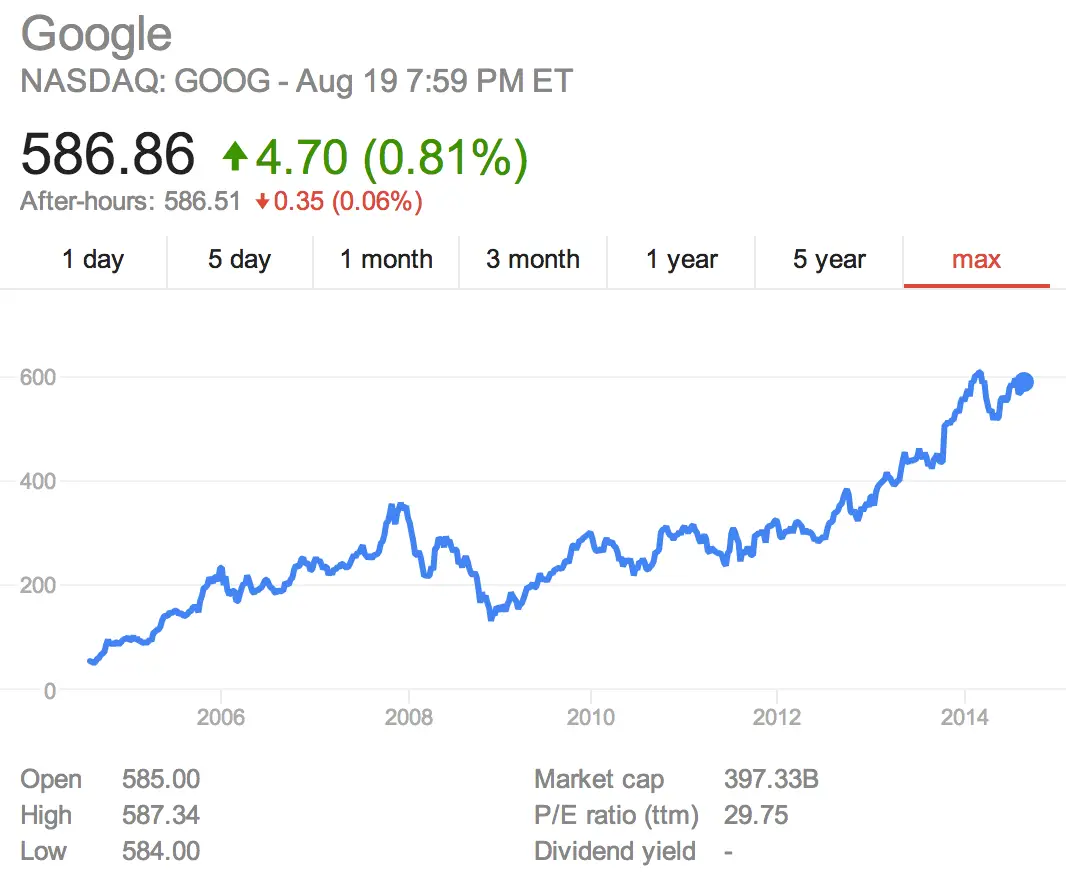

While there’s no question of the value of Google’s stock — rising 1,293% during their first 10 years — it may surprise you to find companies like Monster Beverage Corp performing better with a 6,406% increase during that same time span, or even Apple at 4,274%.

Google founders Larry Page and Sergey Brin originally agreed to only work together for 20 years and while 2024 is just around the corner, it’s interesting to see the huge strides Google has made in just a short amount of time. And where nobody could have guess Google would take over the smartphone market, it’s almost scary to think of where they (and us) will be another 10 years from now.

[Google]

And yet for the past 10 years, despite all of the new projects, 90% of their income still only comes from advertising. Their revenue growth has been slowing down for the past 2-3 years, and they still have yet to solve the problem of Android users buying more less apps from the Play Store.

The 2-3 year slow down is a result of web traffic moving from desktop to mobile but advertising dollars not following suit (as quickly). They’re lagging behind quite a bit, but eventually it’ll catch up. It’s kind of like the difference between the front car of a roller coaster and the whip of the tail.

They’re extremely well positioned to remain the most dominant tech company of our generation when you take everything into account.

And boy do THEY TAKE EVERYTHING in account

as in THEY BUY EVERYTHING that ACCOUNTS for some possibility of future competition in their prediction models.

Buy them before they get big so you clear out future competition and grow more yourself….great strategy I would say.

Yes most of their income comes from advertising and that’s worked out great for us. If their growth is slowing, I wish my future looked as bleak as Google’s.

I wonder why Larry and Sergey chose to only work together til 2024??? I mean, they founded the company, why not run it together indefinitely? I just don’t get it.

(1) Maybe they know how easy it is to get sucked into something forever and they wanted to force themselves to test new waters by drawing a line in the sand, or (2) Maybe they didn’t know Google would be so successful and grow and branch out in so many different directions and that 20 years will get extended, but most likely (3) I have no clue

but in another ten years,they will be back as they started,another bunch of charlatans trying to makea quick buck with cheap,shoddy products.

when someone comes up with a better,nicer search engine that they cannot buy off,their little dull money tower will collapse,too many folk already loathe them and their company and its crap,shirt life products.

fingers crossed,in ten years time,they willbe like what apple is rapidly becoming,a yank firm,selling to other yanks only,in a niche market and ignored by rest of the world because we move on quickly.

cash is not the only measure of success.

short term money grabbing versus learning how to do one job well over long period and make even more cash,possibly,guess which type google are ???

+whats their stock going to do when the e.u and others sieze google and others assetts and accounts for persistent tax evasion ?

the tel aviv trio wont look quiteso rich then will they,take googles/apples/ms and others illegal,unpatriotic foriegn hoards away andthese firms stock will suddenly show their real worth,nothing.

as others point out,it allcomes from advertisers,who,when they realise that the entire market is based on bs and that they do not need to give google anything at all,what then,whatwondefful new product will they “innovate”then ?

none,because they cannot,one hit wonders,with an awful history of flops,about as well thought of as ms by the public,but then what do you expect from firms that employed the likes of that stupid fat clown ballsman,now where he belongs,ina small building,shouting nonsense at a load of idiots on drugs..

google rely on advertisers and others being lazy and not realising that their firms can make more money by spending less on adverts with google etc and more on folk who may actualy buy their products

And yet they don’t produce anything but vapourware. Proves that Wall Street loves hyped up product announcements that don’t deliver anything. So what good is it again?