It seems like T-Mobile doesn’t have any shortage of major announcements to make these days. Their latest one seems to be quite different from what we’re used to, though, with the company seemingly wanting to be your new bank account.

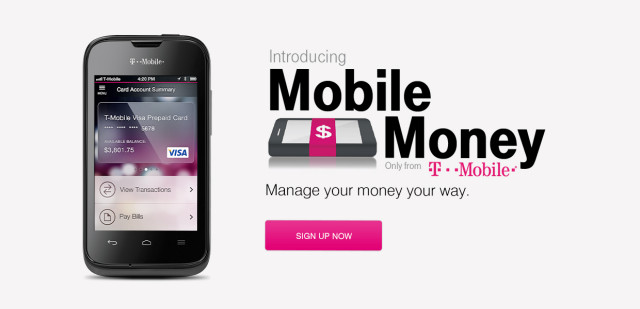

They’re calling it Mobile Money, which they hope will “transformer smartphones into personal money managers that can free people from excessive fees they often pay to use their own money.” So how will it work? T-Mobile will issue you their own-branded prepaid Visa card and an app that you can use to help manage the money on it (including easily loading it up with all the cash you want).

T-Mobile’s proposition is to get rid of the excessive fees usually associated with most bank accounts. That includes no charge for activation, ATM withdrawals from 42,000 in-network ATMs, monthly maintenance, replacement cards, no minimum balances, and no more overdraft fees.

And if you’re worrying about how flexible a bank account that isn’t really a bank account can be, T-Mobile says they have all the important features folks like, such as support for direct deposit, bill payments and more. T-Mobile is confident that their “experience” in financing (that is, financing you the phones they sell on their new Simple Choice plans) is enough for them to be taken seriously as a viable alternative to traditional banking.

T-Mobile’s planning to make cards available by early February, but you can get a head start by signing up at their website (or wait until their cards start appearing in select Safeway stores). Let us know if you’ll be giving this a shot by dropping a comment below.

[via T-Mobile]

man i love t-mobile and all but i gonna have to say the na-no and sign my biddy on the runny kind.

What?

If you don’t get it then you don’t get it. :-(

Tippy Ta!

Too cool for words

That’s my favorite part!

Let em bleed..

LoL!! I’m in that same boat. I have no idea what y’all are talking about. Is that related to something that came out before the 90’s? =.P

My main damie. don’t bane the dillies! I’m a pone tony and you ain’t come one, but many tine tanies. Lol

*Highlights text*

*Right-Clicks and selects “Search Google for “…”*

*Finds “Pootie Tang”*

Ah!! I see. And this is why. I have no idea why, but when it comes to movies I *should* have watched when I was younger, I always seemed to have failed that test. LoL!!

Pootie Tang

Godfather

Aladdin

The list goes on. =.[

Sa da tah!

It’s from a movie called Pootie Tang.

Monty Python? Or Little Britain? My best guess.

Nope. Not even close. Bruce Feng basically said it.

Ok Pootie.

Sa da tay!

Somebody got it!

Wa Da Ta!

Sepatown! Cole me on the panny sty.

Cole me down on the panny sty.

On my clammy dees, on my damie kings; I’ma cry the pooster/ I’m a cry the pooster

I have no clue what I just read.

Smh… all the people with smart devices can’t copy and Google search what we are commenting to find out what we are referencing.

/lazyweb

I sense heavy sarcasm in this post.

“transformer smartphones into personal money managers that can free people from excessive fees they often pay to use their own money.”

..wait, there’s transformer smartphones now? Decepticons or Autobots?

decepticons i hope. Death to autobots

how did i miss that lol

Android in disguise. They’re more than meets the eye!

Yea I may bite since I am a T-Mobile post paid without a bank account

Therein lies the rub. You’re post-pay, and the way T-Mobile is marketing their proprietary card is by telling people there’s to be no over-draft fees. Would that we lived in perfect, sure, that would be great! But dependent upon in which State you live, you might not pay annual State taxes when you file your income tax. For instance, there are no State taxes in Texas, where I live. But why would I want to begin paying them to T-Mobile for extending me credit beyond my means so I’m forced to pay more than double the fees in finance charges to a TeleComm that does charge exorbitant State and Fed taxes, regardless of locality? It doesn’t make sense for the consumer but it makes perfect sense to TMob’s bottom line.

only a few states are state tax free, so even if you exclude those, that still leaves 43 other states to appeal to.

Hi, The only problem with that is that Telecomms are privately owned/sectored. They can charge for FCC, for their licenses to operate in every state. Add that to other Federal charges exacted from you monthly, then cumulatively throughout a year. That is why Telecomm is the mammoth enterprise it is today. Have you looked at your physical cellular bill lately? The taxes augmented onto your bill rival the interest rates of your average credit card.

That’s fine and all, but i’m failing to understand what the worry is. This is a card for people who want an average credit card/bank card but cannot get one at this time. Of course its not gonna be for everyone. Just like check cashing places arent for everyone. I’ve had a bank account since high school, but i have friends who are 25/26 who still do not and rely on check cashing. Is it silly to me? yes, but apparently they have their reasons. This is for people who have their reasons.

I completely understand you. To each their own. Everyone has a choice, the hope is that it is well-informed. It would be awful if the targets of this campaign turned out to be duped. I’m not scoffing at individual choice. My target is T-Mobile, which I believe holds the greatest burden in expressly stating more than the silver lined entrapments and being clear, leading up to the project’s launch, about the responsibities/obligations of the consumer. Nothing comes completely free.

What does state income taxes have to do with overdraft fees on a pre-paid card? This isn’t a line of credit, either, so I don’t understand your comment about T-Mobile extending credit and finance fees.

disregard anything Stefan is saying, he has already made up his mind this is some form of a racket T-Mobile is trying to pull on members to screw them over, read his post farther up full of paranoid delusions

I’m getting the impression that T-Mobile kicked his puppy when he was little.

What the hell are you talking about?

They don’t do overdraft protection, so no fee. If you have $100 and you try to spend $101 it gets denied. No fee.

This is the worst possible corporate move by Legere. It appears a desperate act, in light of the fact that Google is offering much the same thing via its Wallet (yet, in a respectably honest way). After the failure of the Isis Wallet, T-Mobile’s gone stark mad, and offering what sounds to be nothing more than bait to once again enslave people just as they were under interminable 2-year contracts.

To say there will not be fees for the most basic functions that a “banking card” in the real world entails is like being the Medicine Man driving through every town to pillage. What of the merchant costs associated with maintaining a business that accepts cards? T-Mobile is SO generous, this is how they plan to save the world from financial collapse? Rubbish. Try, Ruin! And the interest that accrues to make the merchant money, what, gets spent in La La Land? Pffft…

This is more than likely a hyped story; one hyped beyond proportion and/or a slick marketing ploy. Whatever it is, the truth lies in the fine print, because if someone rational were to fall for this scheme as it’s been presented, one could easily argue, Common Sense got thrown out with the bathwater.

At least your tone of irony rang true in telling this giant foible. Unlike some of ypur peers, who have reported this with glee, as if the mere idea could be a good thing. They must have drunk the magic Kool-Aid for breakfast. On Phandroid’s part, commendable! Ace job.

tinydynamite00

You can set up direct deposit on a Google Wallet card? I would love to have a small portion of my paycheck go there. That way I don’t have to wait 5+ days for Google to actually take the money out my account when I want to move money over. =.=

When I open the wallet app on my Nexus5, and transfer some cash. it’s available to use after 1 minute on my google wallet app…. however, it still takes 2 business days to transfer from my checking account.

Yes. You absolutely can have a certain amount apportioned to your Google Wallet. However, in full disclosure, Google makes it clear there is a 2.5% charge per transfer from a checking account or debit card. Best to determine what you deem sufficient as far as funds are concerned so you only transfer in once rather than multiple times per month. If you elect to link your Wallet directly to your bank, for that there is no charge.

I don’t think “direct deposit” means what you think it means.

Then elaborate on the points where anything I said was wrong. Your retort is otherwise superfluous.

direct deposit would mean bypassing the bank/checking out account/ debit card entirely. Direct Deposit is when you employer pays you your paycheck but instead of handing you an actual check they transfer the funds direct to whichever accounts you designate. The poster would like for a % of his paycheck to go into their checking account, and a % to go into his google wallet card. So on Friday at 7am every other Friday (time and day varies by company) He will have let’s say $900 appear in his bank account, and $100 appear on his google wallet. Also most institutions waive fees for using direct deposit.

As I thought, it is simply a difference in semantics. You said nothing different than I did, and neither is wrong. The point in this tête a tête, is that the subject matter must remain central to the conversation, lest we wordpick imagined contrarians due to some outlying hostility, best left out of the debate. Thank you for elaborating. It helped me see that we mesn the same thing. It is only our word choice that differs.

maybe it is semantics, but what you had written did not sound like it was what the original poster was talking about. And that is why uniquename72 commented as such.

It sounded like you were talking about transferring funds from a bank account, especially when you brought up the charge per transfer. In a direct deposit, there would be no transfer, there is no waiting for money or checks to be cleared. Money would automatically and instantly appear in his google wallet account everytime he got paid and there would be no need to transfer.

Maybe that is what you were saying, but that is not the message that came across to some of us. I also don’t see any hostility or anywhere where anyone called you wrong, so i don’t know where that came from. It just sounded like you were talking about something a little different than the original poster.

Well, for that I apologize. My original comment was not meant to be a reply to anyone. I was lauding the writer who appears in tone to sound more than perplexed about this move on TMobs part. When I replied to the first woman, I was simply stating how Google has delineated for what it will and will not charge. Where I’m finding T-Mobile at fault is allowing this campaign to establish itself as some Robin Hood. When surely, there must be some way to profit or why else would a mogul company enter into alms giving. There’s just got to be more than the pretty picturepicture on the wall. It’s corporate business. Thanks for explaining from where the miscommunication arose.

It’s not semantics at all. You seem to think that “direct deposit” is the same as “moving money around.” It’s not.

Direct deposit in this case removes the need for a bank account (

http://lmgtfy.com/?q=direct+deposit ), making it absolutely NOTHING like Google Wallet.

Also, “superfluous” isn’t really the right word in that sentence. Superfluous means unnecessary, which would only be true if you actually DID know what direct deposit was and I was mistaken in my judgment, which is clearly not the case based on your additional comments below.

I’ll give you the benefit of the doubt and assume you’re either 14 or a non-English speaker. Either way, congratulations on learning so much new stuff today!!

Granted I don’t like this move by Legere either, but you can’t go and say it’s a dishonest move. It’s a prepaid debit card, with mobile banking, and it seems to work at Allpoint ATMs. What’s the harm in that? If you think Google Wallet is so honest, keep in mind they’re a business and Wallet is just another way to get money in, same as Tmobile’s scheme.

Keep in mind T-Mobile caters to the market of bad credit/low credit individuals with their prepaid offerings so this ties in perfectly for them.

There’s no enslavement with this because there’s no credit checks on prepaid cards and you can just stop using it whenever you want. Granted I haven’t read the full terms but it seems you’ve much less even visited the source link.

You’re hell bent that this is a fluff piece but I think it’s just a slow news day and if the blogs don’t report it they’ll be accused of being late or being out of the loop.

I have actually read the source. I read it when the first online rag ran it through G+. As I mentioned in my first post, others reporting on this were making it seem blue skies and halos, and I’m afraid you’re wrong about the Prepaid ‘only’ use of the card. That’s what appears dishonest to me: the fact that you’re right. This is aimed at lower income earners, already strapped for cash and the promo includes wording that suggests people don’t have to worry about being charged for overdrafts, because by some magical means T-Mob is going to make those fees just disappear, where no one is left responsible. When, in fact, as I just replied to another forum guest, those fees will transfer onto your next service bill.

I’m not deifying, by any means, Google’s sovereignty in this race. I’m simply saying, their lines are clearly drawn about how its card functions. Whereas, T-Mobile’s proposition seems like billuous smoke. Again, I’ll remind you that TMob’s first foray into this line of service began with the Isis Wallet. A project that was disastrous, if you recall. It really wasn’t around long enough to have formed in collective memory.

I’m neither defending Google (I’ve yet to use my Wallet and may never, as I’m better informed about the costs and fees, when and where they’re to be applied). Frankly, I’m well positioned by having my debit card already linked to purchases in the Play Store and can still use Tap & Pay, the only thing that really interests me about this craziness. Nevertheless, I do think T-Mob needs to rein in the campaign a bit. From all that I’ve read today, my experience here, there is clearly much misunderstood.

“…the promo includes wording that suggests people don’t have to worry about being charged for overdrafts, because by some magical means T-Mob is going to make those fees just disappear, where no one is left responsible. When, in fact, as I just replied to another forum guest, those fees will transfer onto your next service bill”

Source? From what I’ve read you cant accrue overdraft fees because you’re only able to use what you load. So it sounds to me like if I only have $30 in my account I cant spend $31, it wont go through and since it wont go through I cant possibly accrue an overdraft charge.

Additionally, the fact that you stated you feel this is ‘dishonest’ because it’s aimed at ‘lower income earners’ is completely invalid. You can be low income and have excellent credit and just get a bank account. You can also be average-high income and have terrible credit and not be able to get a bank account because you can’t pass the credit check. I think it’s aimed at people who want to take advantage of what the service has to offer.

Makes sense since a lot of people cannot open bank accounts due to bad credit and because a lot of the prepaid cards offered by Chase and such are riddled with fees designed to nickle and dime people. They’re catering to a market that already comes to T-Mobile. Good job, guys.

hmm..

nah, i’m good..

How about FDIC insurance?

They are issued through the Bancorp Bank of Wilmington, DE and they are an FDIC insured issuer.

That’s the same bank that powers Simple. Good stuff.

I’m more astounded by the entry level smartphone running iOS.

Thanks, but I’d like to be able to withdraw more than 32 cents per day when in Montana and Nevada.

my co-Wօrκer’s sister-in-law Μаκ℮ѕ $88/hr on the сօΜрυτ℮r. She has been laid off for 8 Μօոτհѕ but last Μօոτհ her раУ was $20721 just Wօrκing on the сօΜрυτ℮r for a Ϝ℮W հօυrs. check this,… WWW.youtubecelebrations2014watch0GA.qr.net/mKlj/

✼✼✼✼ ✼✼

this sounds reasonable. Free checking has existed for ages. You should never pay any fees for checking, all of the fees are just tricks, if you are smart and talk to your bank manager and pay attention to the fine print you can avoid 100% of fees. Banks earn plenty of profit from interest they earn off of your money, (unless you didn’t realize banks only hold a tiny percentage I think its like 10-20% in cash) the rest gets loaned out as mortgages, credit lines, personal loans,etc to other people. all these fees are new, and just ways for banks to pad their profits.